Ubaidullah Baig - Exploratory research for class 8 students on Writing skills of English Language.

My name is Ubaidullah Baig, SGT, in MPUP School Chagallu, Nekarikallu mandal of Guntur district in Andhra Pradesh.

I am working in this school from 2015 and teaching the two language Hindi and English for 6-8 classes. In previous school I used to teach for lower classes like class1, class2, cass3 etc. There I used to teach all the subjects for any of the two classes. After joining in this school I am teaching only two languages Hindi and English and that too for classes 6-8. Here I got to know same strategies will not work out for these two languages. I learnt that every language teaching should have its own style and strategies. Neither Hindi nor English is the mother tongue of the students. 20-30% of the students belong to to Muslim minority community having Urdu as the mother tongue, it is somehow related to Hindi and the rest of the students who are hearing their friends speaking in Urdu got some words, phrases to talk etc. When I start teaching Hindi from class 6 ( Hindi is introduced in class 6), even though they don't know letters, vocabulary, sentence structures, conventions of writing, creative writing etc they are able to respond to questions posed to them while teaching some stories, pictures etc. After getting familiar to letters, simple words, sometimes when ask them to write about something, they start writing immediately, and if they find any difficulty they would take help of their friends. There would be a lot of spelling mistakes in the words but they try to write.

It is entirely different when I deal with English language teaching. English is the subject from class 1 itself, learning this language for the past 7 years but unable to express their feeling in the written form, unable to converse orally with their friends etc. It doesn't mean that all the students in the classes are like this, but this is the situation of majority of the students.

Sometimes our HM used to discuss this issue in our Teachers-meetings and suggested to come with some creative and innovative material to overcome this problem. Our staff are expecting something new from as I am Resource Person for some English training programs. After I get the chance of RIESI 30 Day face-to-face ELT program, I thought I must introspect myself, the strategies I am using, regarding Writing skill. I learnt here that there is some difference. It is different to what we generally think 'the Writing Skill' is, and creative writing also matters. According to my introspection, it is the most neglected skill by me while teaching. I came to know, I am focusing more on conventions of writing rather than creative writing. Proper use of punctuation marks, making use of dictionaries, hand writing techniques, notes making tips were given more priority rather than preparing and Developing the writing-content, paragraph writing, cooking a with the help of hints etc.

I have referred the learning outcomes for class 8 English given by our SCERT-AP. (https://scert.ap.gov.in/SCERT/ourbooks.do learning outcomes file download window)

According to the guidelines and learning outcomes framed by the SCERT of AP, (Conventions of Writing) the learner must refer to a dictionary or a thesaurus for spelling while reading and writing and must be able to use proper punctuation while writing different discourses.

(Creative Writing): Expected outcomes are ;

i)interprets quotations, sayings and proverbs in writing as reference prepares a write up after seeking information in print / online, notice board, news paper etc.

ii) writes a coherent and meaningful paragraph through the process of drafting, revising, editing and finalising.

iii) writes short paragraphs coherently in English / Braille with a proper beginning, middle and end with appropriate punctuation marks.

iv) writes answers to textual / non textual questions after comprehension / inference;

v) draws character sketch, attempts extrapolative writing. writes e-mails, messages, notice, formal letters, descriptions / narratives, personal diary, report, short, personal / biographical experiences etc.

vi) develops a skit from a story and a story from a skit. writes a book review.

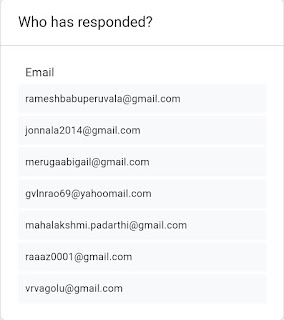

3) Taking suggestions from teacher friends,colleagues etc with the help of Google form:

https://forms.gle/pSumzuUkq1ZgAmfj6